Hydrogen Market

Hydrogen substitution opportunities

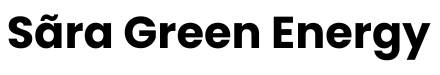

In the short term, hydrogen will be applied first in those sectors that are under societal pressure to decarbonize and those where electrification cannot be a viable economic option. In the medium term. Industrial feedstock and electricity buffering are also likely to be decarbonized by H2 , as well as potentially some niches in other mobility applications and the built environment. In the longer term, the production of chemical feedstock (as ammonia) produced from H2 will enable the decarbonization of the hardest to abate sectors such as shipping and aviation

Hydrogen vs. Other Energy Sources

2023 Price: 20 to 30 €/MWh

Expected Price in 2050: 25 €/MWh

2023 Price: 40 to 60 €/MWh

Expected Price in 2050: 35 €/MWh

2023 Price: 100 to 120 €/MWh

Expected Price in 2050: 20 €/MWh

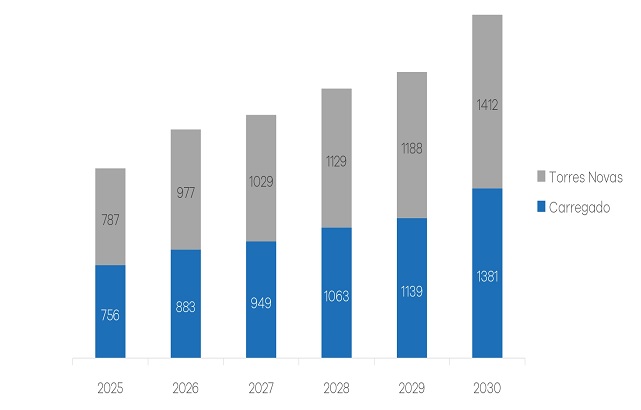

H2 tolerance of gas infrastructure components

Overview of typical risks in green hydrogen projects

Blending concentrations greater than 20% hydrogen by volume would require significant changes to existing infrastructure and enduse applications.

It may therefore be more economic to transform the entire infrastructure and applications to work with pure hydrogen on a local or regional basis (e.g., in a particular neighborhood).

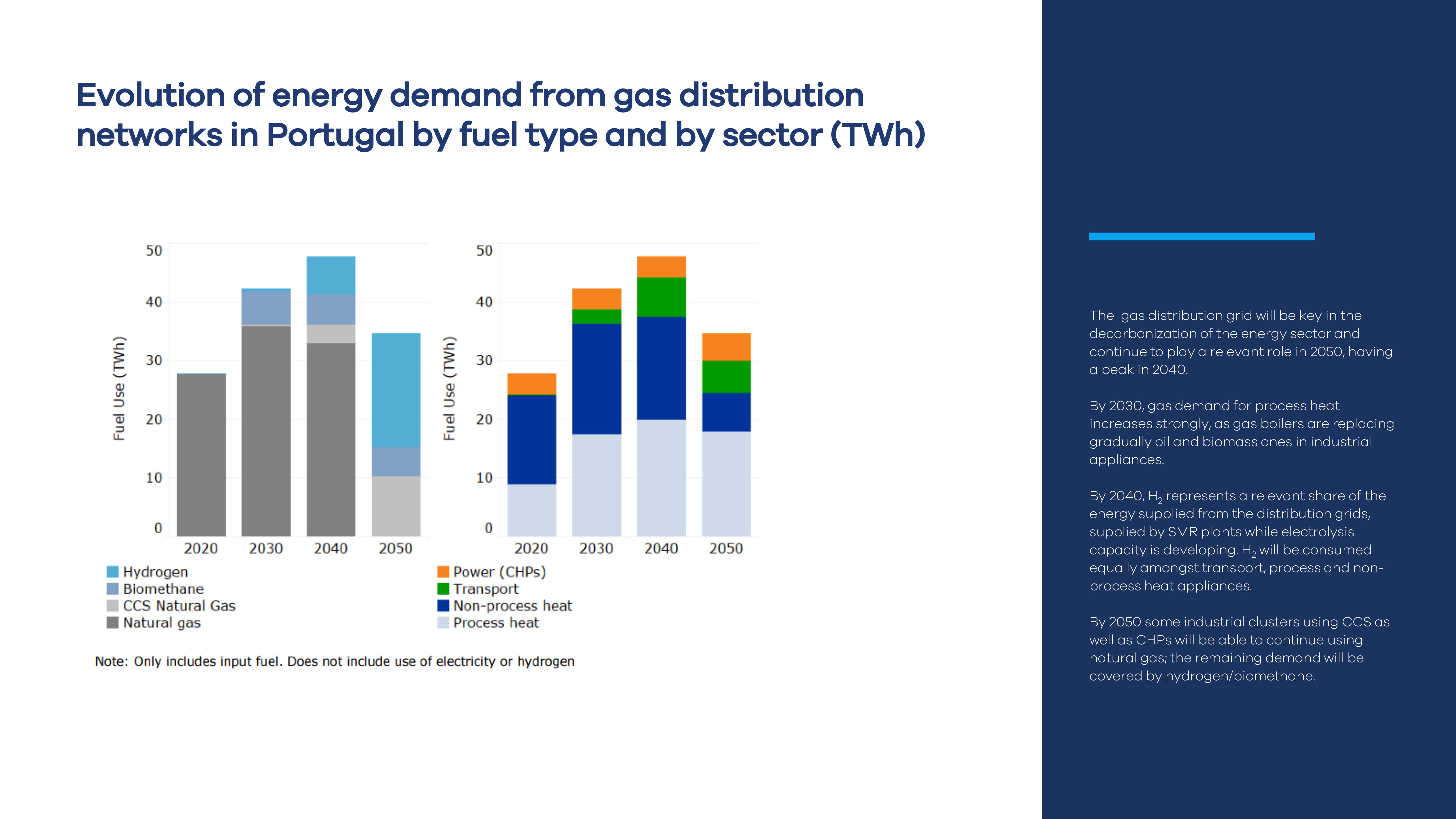

Examples of Ongoing H2 projects

Portugal

Acquisition of a new steam boiler which will run on green hydrogen in Setúbal plant.

The project, led by Floene, involves other Portuguese companies, and was the first hydrogen injection into the gas grid in Seixal, Portugal. Over the next years, the aim is to increase the volume of H2 to 20%.

The Cascais Municipality has pioneer routes with buses fully powered by hydrogen.

Worldwide

- ThyssenKrupp :- It is investing in H2 to reduce CO2 emissions in steel production, namely from furnaces.

- Saint-Gobain :- The company is replacing natural gas with H2 in its melting furnaces. The company has already produced flat glass using 30% H2 and plans to use 100% H2 by 2030.

- Ceramtec :- It is replacing natural gas with green hydrogen in its German ceramic's operations. The project, is expected to cut the company's CO2 emissions by 500,000 tones per year.

Carbon Tax Implications

Carbon taxes are steering the transition towards cleaner energy. All three carriers feel the impact, but Hydrogen's low carbon footprint positions it favorably in a carbon-constrained world. It aligns perfectly with sustainability goals.

EU Carbon BorderAdjustment Mechanism (CBAM)

The EU's CBAM is set to reshape global trade. Beginning in 2026, it will require importers in selected sectors, including cement, aluminum, electricity and others, to account for the embedded emissions of their products. This ambitious measure reflects the EU's commitment to carbon reduction and sustainability.

The major building blocks for competitiveness

Competitiveness for green hydrogen in Portugal, like in many other countries, depends on several key building blocks and factors, as: renewable energy resources, EU policies, financial incentives for market development, and country competitive factors.

EU policies

- Green Deal

- Fit for 55

- RePowerEU

- Green Deal Industrial Plan

- Among others

Financial incentives which promote green H2 adoption

- Industry decarbonization (RRP)

- Innovation Fund

- EIC

- Among others

Portuguese competitive factors

- Climate

- Strategic location

- Safe and secure country

- Social and political stability

- Innovation & development